You just closed on your Florida property. You got a great interest rate by qualifying as a primary residence. The ink is barely dry on your documents. Then someone says, "Just quit claim it into your LLC tomorrow. It's simple. Everyone does it."

Stop right there.

That advice can cost you tens of thousands of dollars. It can put your loan in default. It can trigger tax bombs. It can void your title insurance coverage. In extreme cases, it can lead to civil liability or criminal fraud charges.

This is not theoretical. We see this happen at Independence Title. Buyers follow internet advice or casual suggestions without understanding the legal, tax, and lending tripwires they are stepping over. By the time they discover the problem, the damage is done. The lender is demanding immediate refinancing. The tax bill arrives. The title claim gets denied.

Let's walk through exactly why deeding your Florida property to an LLC after closing can go very wrong, and what you need to do instead to protect yourself the right way.

Why People Want the LLC in the First Place

Let's be fair. The goal makes sense.

You want liability protection. If a tenant gets injured or a lawsuit hits, you want a firewall between the property and your personal assets. You want clean bookkeeping. You want to separate this investment from your personal finances. You might be partnering with someone else and need a clear ownership structure. You want asset segregation so this property sits in its own legal bucket.

All of that is legitimate. Asset protection matters. Business structure matters. Partnership clarity matters.

But here's the pivot: the method matters just as much as the goal.

You can't shortcut your way to protection. You have to build it the right way, with the right timing, the right paperwork, and the right professionals involved.

The Big Misconception

Here's what gets people in trouble.

A deed is not just paperwork. A deed changes ownership.

And ownership changes trigger rules. Federal rules. Florida tax rules. Lender rules. Insurance rules. Title insurance rules.

When you sign a warranty deed or quit claim deed transferring your property from your name to "ABC Holdings LLC," you are not filing a form. You are executing a legal transfer of real property. That transfer has consequences.

Risk Bucket 1: Mortgage and Occupancy Fraud

This is where people get hurt the worst.

Here's how it happens. You apply for a mortgage. You want the best rate, so you qualify the loan as a primary residence or second home. The lender approves you based on that use. You sign closing documents. You sign an occupancy affidavit promising you will live in the property as your primary residence.

Then you close. And the next week, you deed it into your LLC. You rent it out. Or you never move in at all.

That's a problem. A big one.

You just misrepresented your intent to the lender. You obtained financing under terms you never planned to follow. That can be considered mortgage fraud under federal law, specifically 18 U.S.C. § 1014, which criminalizes knowingly making false statements to influence a federally insured lender.

The consequences stack up fast:

- Loan default. Your transfer violates the loan terms.

- Forced refinancing. The lender can demand immediate repayment.

- Loan acceleration. The full balance becomes due.

- Civil liability. The lender can sue for damages.

- Criminal exposure. Depending on the facts, intent, and dollar amounts, prosecutors can pursue fraud charges.

Lenders and their quality control teams look for patterns. They audit files. They cross reference deed records with loan applications. They compare your stated occupancy with rental listings, tenant records, and tax filings.

Red Flag Language That Gets People in Trouble

- "I'll just deed it after closing. They'll never know."

- "My loan officer said it's fine as long as I close first."

- "I can always change my mind about moving in."

- "It's only fraud if I get caught."

If you hear yourself or someone else saying these things, stop. Get legal advice before you do anything.

Risk Bucket 2: Due on Sale Clause and Loan Acceleration Risk

Most mortgages include a due on sale clause. This is standard language, usually found in Paragraph 18 of the Fannie Mae/Freddie Mac Uniform Security Instrument.

In plain English, it says this: if you transfer or sell the property without the lender's consent, the lender can declare the entire loan balance immediately due and payable.

A transfer to an LLC is a transfer. It triggers the clause.

Now, here's the reality. Some lenders do nothing. They don't monitor. They don't enforce. Borrowers get away with it for months or even years. But that doesn't mean the risk disappears. It means the risk is sitting there, waiting.

When does it blow up? When interest rates rise. When the loan gets sold to a new servicer. When the file gets audited during a portfolio review. When the market shifts and the lender wants to reposition the asset.

At that point, you lose all leverage. The lender can demand refinancing at current market rates. If rates have gone up 2% or 3% since you closed, your monthly payment just jumped by hundreds of dollars. If you can't refinance, the lender can foreclose.

Federal law does provide some exceptions under the Garn-St. Germain Depository Institutions Act of 1982 (12 U.S.C. § 1701j-3). Transfers to certain living trusts or transfers where the borrower remains an occupant may be protected. But transferring to an LLC for investment purposes does not qualify for these protections.

Here's the test: If you would not want this reviewed by an underwriter, do not do it.

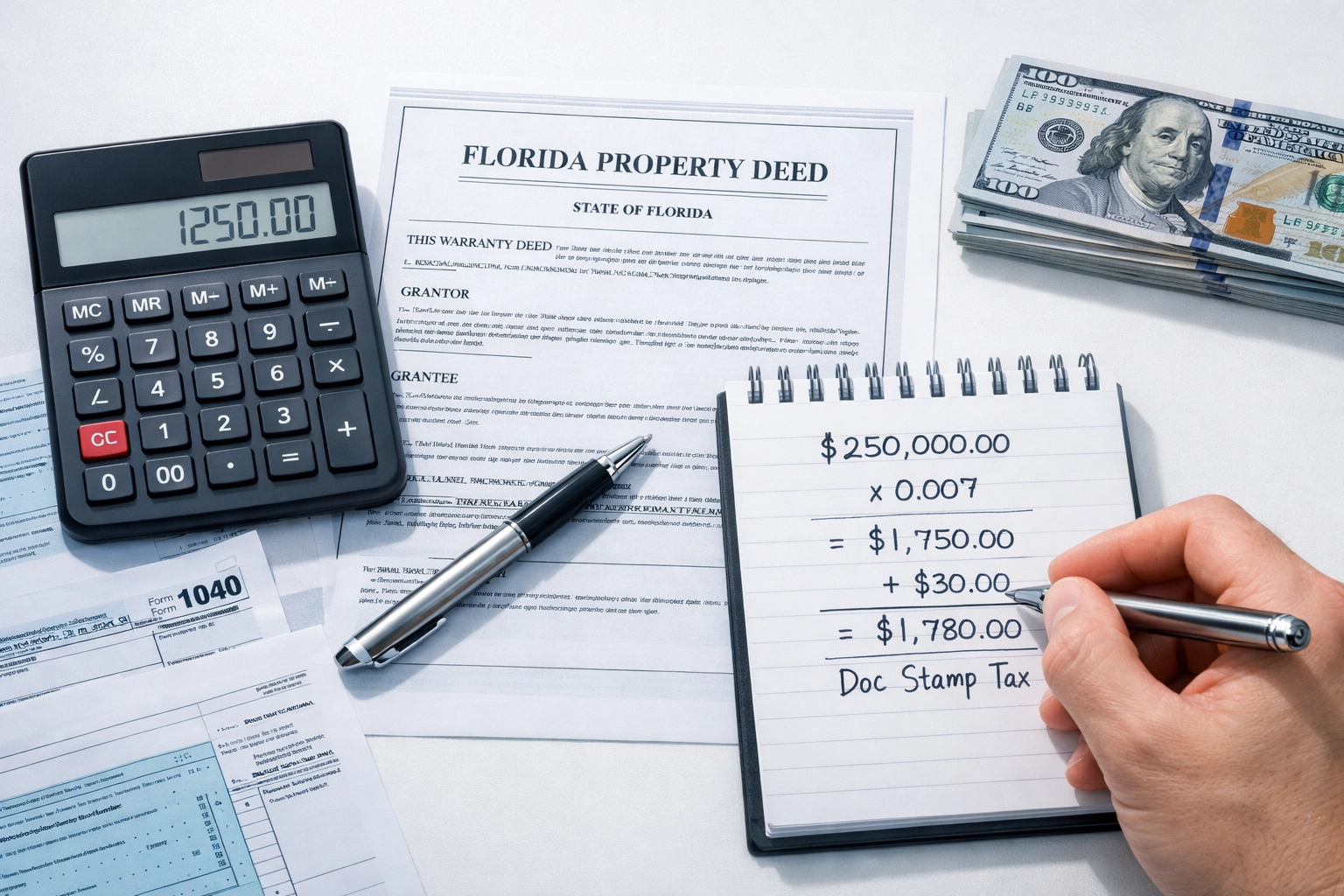

Risk Bucket 3: Florida Documentary Stamp Tax

Recording a deed is not free. In Florida, you owe documentary stamp taxes when you transfer real property.

Florida Statute 201.02 sets the rate at $0.70 per $100 of consideration. And here's the kicker: consideration includes the existing mortgage balance, even when no cash changes hands.

Let's run the math.

You deed your property to your LLC. The property has an existing mortgage balance of $400,000. No money changes hands. But the LLC is taking title subject to that debt.

- Consideration: $400,000

- Doc stamps: $400,000 ÷ 100 = 4,000 taxable units

- 4,000 × $0.70 = $2,800

That's $2,800 in Florida documentary stamp tax you owe when you record the deed. Some counties charge additional surtaxes. Miami-Dade, for example, adds another $0.60 per $100 on properties over $100,000, which would add another $2,400 to the bill.

If you don't pay it, the deed can be challenged. You can face penalties and interest. You can cloud your title.

Confirm the exact tax due with a Florida CPA or title professional before you record anything.

Risk Bucket 4: Title Insurance Coverage Problems

When you closed, you received two title insurance policies. One for you (owner's policy). One for your lender (lender's policy).

These policies insure the named insured. That's you. Not your LLC.

When you transfer the property to your LLC, you change the insured party. Most standard ALTA (American Land Title Association) owner policies include limited continuation of coverage for certain successors or transfers, but not all transfers qualify. And the language varies by policy form and state.

If you deed to an LLC and assume you are still covered, you are guessing. If a title defect appears later and you file a claim, the underwriter may deny coverage because the insured party changed.

You may need an endorsement or a new policy to protect the LLC. That costs money. And if you don't get it, you are self-insuring title risk on what may be your largest asset.

Pull your owner policy. Read the definition of "Insured." Call your title company and ask if your coverage will continue after a transfer to an LLC. Get the answer in writing before you record the deed.

Risk Bucket 5: Other Issues People Forget

Homestead and Property Tax Implications

If the property is your primary residence, you likely have a Florida homestead exemption. That exemption saves you thousands of dollars per year in property taxes. It also caps your annual assessed value increases under the Save Our Homes amendment.

When you transfer your homestead property to an LLC, you lose the exemption. Your property gets reassessed at full market value. Your taxes skyrocket.

Example: Your home is worth $500,000. Your assessed value under Save Our Homes is capped at $300,000. You transfer to an LLC. The county reassesses at $500,000. Your annual property tax bill just jumped by thousands of dollars.

Insurance Underwriting

Your homeowner's or landlord insurance policy was issued based on individual ownership. When you transfer to an LLC, the underwriter may re-rate the policy or require a commercial policy. Premiums can increase. Coverage terms can change.

Garnishments and Asset Protection Myths

An LLC is not a force field. If you transfer property into an LLC to hide it from existing creditors or judgments, courts can reverse the transfer as a fraudulent conveyance. If you fail to maintain proper LLC formalities (separate bank accounts, operating agreements, meeting minutes), courts can "pierce the corporate veil" and expose your personal assets anyway.

Partnership Disputes

If you own the LLC with a partner, who controls the property? Who makes decisions? If your operating agreement doesn't match your ownership intent, you are setting yourself up for disputes down the road.

Recording Errors and Clouded Title

If you use the wrong deed type, misspell the LLC name, fail to pay documentary stamp tax, or record without releasing an unpaid lien, you cloud your title. Fixing title defects later is expensive and time consuming.

Who Is Responsible When a Lender or Loan Officer "Told Me to Do It"?

Let's be clear about accountability.

You signed the papers. You own the risk.

If a lender, loan officer, real estate agent, or internet guru tells you to "just quit claim it after closing," they are playing with fire. And so are you if you follow that advice blindly.

Professionals who give blanket advice without understanding your specific facts, your loan terms, your tax situation, and your title coverage are not protecting you. They are guessing. And you are the one who pays when the guess is wrong.

Best practice: Get lender consent in writing. Document your plan. Do it the right way.

The Safe Playbook: 10 Steps Before You Deed Anything

Before you record a Florida deed to LLC after closing, follow this checklist:

-

Pull your note, mortgage, and riders. Find the due on sale clause. Read the occupancy requirements. Know what you signed.

-

Confirm occupancy requirements. Did you sign an affidavit promising to occupy the property? For how long? What are the consequences of violating it?

-

Ask your servicer in writing if the transfer is permitted. Get lender consent before you transfer. If they say no, you have your answer. If they say yes, get it in writing with the conditions spelled out.

-

Ask your title company if your owner policy will cover the LLC. Do you need an endorsement? Do you need a new policy? What does it cost?

-

Ask your CPA about Florida documentary stamp tax. What is the exact consideration? What is the tax due? Are there county surtaxes? When is payment due?

-

Confirm insurance carrier requirements. Will your current policy continue? Will the premium change? Do you need a new policy?

-

Confirm homestead implications if applicable. Will you lose your exemption? What is the tax impact? Is there a way to preserve it?

-

Prepare the correct deed type and correct vesting. Warranty deed or quit claim deed? How should the LLC be named? Is the LLC registered with the Florida Division of Corporations?

-

Align the LLC operating agreement to the property ownership. Who owns what? Who controls decisions? What happens if a member wants out?

-

Keep a clean file. If this transfer ever gets questioned by a lender, tax authority, or court, your documentation saves you. Keep copies of lender consent, title endorsements, tax receipts, and legal advice.

Asset Protection Is a Strategy, Not a Shortcut

Here's the hard truth.

Asset protection is a strategy. It requires planning, professional guidance, and proper execution. It is not a shortcut you execute with a $50 quit claim deed the day after closing.

If you want to hold Florida real estate in an LLC, do it the right way. Talk to your attorney. Talk to your CPA. Talk to your lender. Talk to your title agent. Coordinate the plan before you close, or wait until you have lender consent and the right structure in place.

At Independence Title, we help buyers, investors, agents, and lenders navigate these transfers the right way. We review title coverage. We calculate doc stamps. We coordinate with your legal and tax team. We make sure you are protected, not exposed.

Reflection questions:

- If your lender reviewed your file tomorrow, would you be comfortable explaining your actions?

- If a title defect appeared next year, would your insurance cover the LLC or deny the claim?

If you are not sure of the answers, let's talk before you record anything. Reach out to our team and we'll help you build the protection you need without the risks you don't.

Disclaimer: This blog post is educational only and does not constitute legal, tax, or financial advice. Every transaction is different. Consult with a qualified Florida real estate attorney, CPA, lender, and title professional before transferring property or making decisions that affect your legal rights, tax obligations, or loan terms.