If you thought wire fraud was bad in 2024 and 2025, you need to see what's heading our way in 2026.

The game has changed: and it's not just getting more common. It's getting smarter, faster, and alarmingly more convincing. We're talking about scams so polished that even seasoned real estate professionals and tech-savvy buyers are falling for them.

At Independence Title, we've been on the front lines of this fight for years. In fact, our CEO Kevin Tacher literally wrote the book on it: Intercepted: Protecting Your Money in the Age of Wire Fraud. But even with all our experience, what we're seeing emerge in 2026 is something entirely different.

Let's break down what's shifting, why this year is critical, and how you can protect yourself.

The AI Revolution in Wire Fraud

Here's the thing that keeps us up at night: artificial intelligence has become the fraudster's best friend.

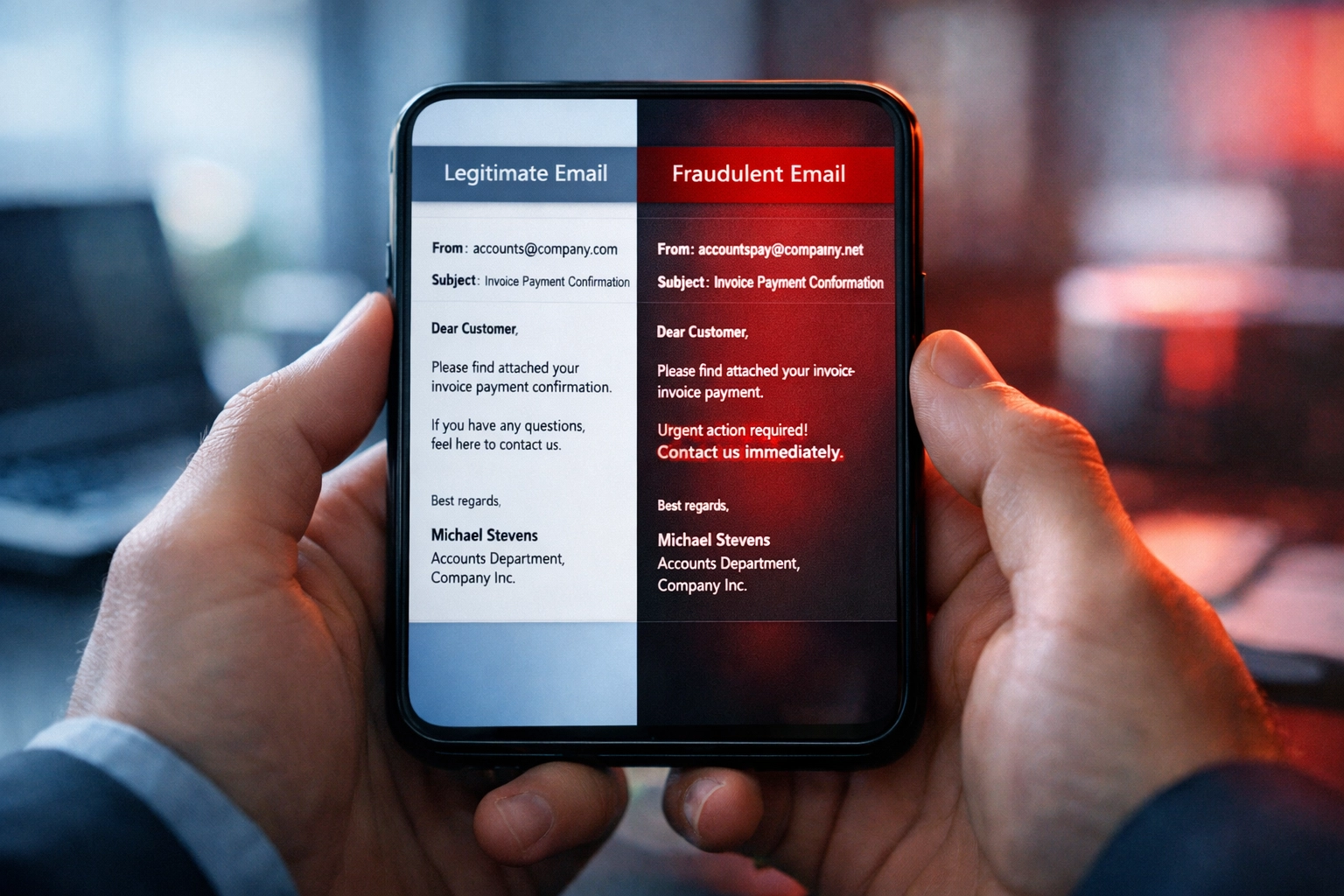

We're not talking about clunky, obviously fake emails anymore. AI has given scammers the ability to create phishing messages that pass the eye test: perfect grammar, proper formatting, convincing signatures, and context that makes sense for your specific transaction.

But that's just the beginning. The real nightmare? Voice cloning and deepfake video calls.

Imagine this: You're days away from closing on your Florida dream home. You get a call from someone who sounds exactly like your title agent: same voice, same cadence, same reassuring tone. They tell you there's been a last-minute change to the wiring instructions. They might even jump on a video call where you can see their face.

Except it's not them. It's a deepfake.

Scammers can now clone a voice from just a few seconds of audio pulled from a social media video, a voicemail greeting, or a YouTube clip. They create convincing video calls using AI-generated faces. And here's the kicker: AI-enabled scams are generating 4.5 times more revenue than traditional fraud approaches.

That means fraudsters are investing heavily in this technology because it works.

Business Email Compromise Gets an Upgrade

Business Email Compromise (BEC) isn't new, but it's evolving rapidly in 2026.

Traditionally, BEC involved hackers gaining access to email accounts and monitoring conversations about wire transfers. When the time was right, they'd send fake wiring instructions from a compromised email address.

Now? They're combining that access with AI-powered analysis of your communication patterns. They know how you write, when you typically send emails, which terms you use, and who you interact with most frequently. They craft messages that are indistinguishable from legitimate correspondence.

We're also seeing a massive uptick in Authorized Push Payment (APP) fraud: where victims are tricked into authorizing transfers themselves. These scams often involve emergency scenarios:

- "Your family member has been in an accident and needs money immediately"

- "There's a problem with your closing and we need to re-wire funds today"

- "The seller's financing fell through: we need your deposit sent to a new account"

The pressure tactics are intense, and AI helps fraudsters scale these attacks to hundreds of victims simultaneously.

Why 2026 Is the Critical Year

You might be wondering: why is 2026 specifically such a big deal?

Several factors are converging right now:

1. Technology accessibility: AI tools that were expensive and hard to use two years ago are now available to anyone with an internet connection. The barrier to entry for sophisticated fraud has essentially disappeared.

2. Data breaches at scale: More personal and business data is available on the dark web than ever before. Fraudsters have detailed information about real estate transactions, agent contact information, and buyer profiles: all before they even make contact.

3. Payment volume growth: ACH payment volumes are increasing by $1 trillion annually, and wire transfers for real estate transactions continue to climb. Where money flows, fraud follows.

4. Detection lag: Security measures are always playing catch-up. The tools we use to detect fraud in 2026 were designed to catch 2024-era scams. We're in a race against constantly evolving threats.

According to recent industry data, 67% of organizations reported increased fraud attempts over the past year. That's not a small uptick: that's a massive wave.

Real Estate: The Perfect Target

Real estate transactions are uniquely vulnerable to wire fraud, and Florida's hot market makes it even more attractive to criminals.

Think about what makes a real estate closing the perfect storm for fraud:

- Large sums of money moving in a short timeframe

- Multiple parties communicating via email (buyer, seller, agents, lender, title company)

- Time pressure to close by a specific date

- Unfamiliar processes for first-time buyers

- Remote closings that reduce face-to-face verification

Scammers monitor email chains between buyers and title companies, waiting for the perfect moment to strike. They intercept conversations, fabricate closing documents, and substitute their own wire instructions at the last possible moment: when you're stressed, rushed, and ready to get it done.

In Florida specifically, we've seen fraudsters targeting snowbirds and out-of-state buyers who are less familiar with local processes and more likely to rely heavily on email communication.

What We've Learned Fighting This Battle

When Kevin wrote Intercepted, it wasn't just theory: it was based on real cases, real losses, and real lessons learned from being in the trenches of title insurance and wire fraud prevention.

The book covers everything from the psychology fraudsters use to the specific red flags you should never ignore. But one theme runs throughout: verification is your best defense.

Here's what that looks like in practice:

Never trust wiring instructions sent via email: ever. Even if the email looks legitimate, even if it comes from an address you recognize, pick up the phone and verify using a number you already have saved (not one provided in the suspicious email).

Use multi-factor authentication for any account related to your real estate transaction.

Establish verification protocols early. At the start of your transaction, agree with your title company on exactly how wire instructions will be communicated and confirmed.

Watch for urgency and pressure. Legitimate title companies won't pressure you to wire money immediately without proper verification.

Be skeptical of last-minute changes. Wire instructions don't typically change at the eleventh hour. If they do, that's a major red flag.

How We're Protecting You

At Independence Title, we've implemented multiple layers of protection specifically designed to combat these 2026-era threats:

We use encrypted communication channels for sharing sensitive information. We have strict verification protocols that require multiple touchpoints before any wire instructions are finalized. We provide clear, written guidance to every client about what to expect and what should raise concerns.

But here's the reality: technology alone isn't enough. The human element matters most.

That's why we emphasize education and partnership. We want you to understand the threats, recognize the warning signs, and feel empowered to question anything that seems off: even if it's slightly inconvenient or feels awkward.

Your closing coordinator isn't going to be offended if you call to verify wire instructions for the third time. We'd rather have you over-verify than under-protect.

The Bottom Line

Wire fraud in 2026 is more sophisticated, more convincing, and more dangerous than ever before. AI has fundamentally changed the landscape, and real estate transactions remain a prime target.

But you're not powerless.

Awareness is your first line of defense. Understanding these evolving threats means you'll be less likely to fall victim to them. Taking simple verification steps: even when they feel unnecessary: can save you hundreds of thousands of dollars.

If you're buying, selling, or refinancing property in Florida this year, take the time to read Intercepted. Understand the playbook fraudsters are using. And partner with a title company that takes security as seriously as you do.

We're here to help you navigate not just the complexities of title insurance and closing, but also the very real threat of wire fraud. Don't hesitate to ask questions, demand verification, and trust your instincts.

Because in 2026, staying alert isn't paranoia; it's protection.

Need help with your Florida closing or have questions about wire fraud protection? Contact our team at Independence Title. We're in this fight together.